Weak propane prices expected despite strong export activity

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, revisits his outlook on winter prices and his reasoning for overall demand conditions.

Catch up on last week’s Trader’s Corner here: Propane inventory starts winter at record high

Recently, we were challenged on our increasingly bearish view of this winter’s propane prices. The challenge was based on the exceptionally strong propane export activity currently underway and the potential for higher crude prices.

To be sure, our bias toward a weaker pricing environment is based primarily on our outlook for domestic demand. We believe weak crop drying, followed by likely El Nino conditions that will impact demand in the higher-consuming north, especially in late winter, are threats to demand. So are a weakening economy and a financially stressed consumer that is struggling against high prices due to rates of inflation not seen for decades. Reports suggest that many consumers are maxed out from a credit standpoint.

Even if a consumer can get credit, it is high. The Fed has increased interest rates from 0 percent to 0.25 percent to 5.25 percent to 5.5 percent during the past year and a half. Increasingly high yields on U.S. Treasuries are causing rates on mortgages and credit cards to go even higher. We read that for someone trying to buy a home, the average mortgage payment nearly doubled over the past 12 months. Rent also has been increasing in response to the higher price of owning. In fact, the U.S. Department of Labor pointed to rent increases as a key contributor to inflation not coming down in September. For these reasons, we feel the consumer will be forced to conserve everything, including propane.

We enter the winter of 2023-24 with record high propane inventories and threats to domestic demand. If higher propane prices develop this winter, they likely will be driven by higher propane exports and higher crude prices.

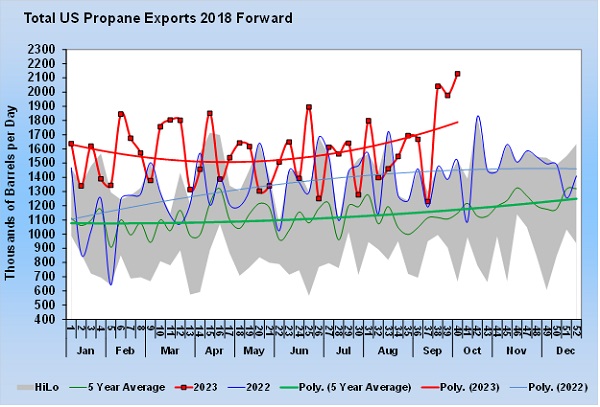

Chart 1 shows U.S. propane exports. It is easy to see why those wanting to challenge a bearish propane pricing environment would point to exports. They are at a record high and trending up.

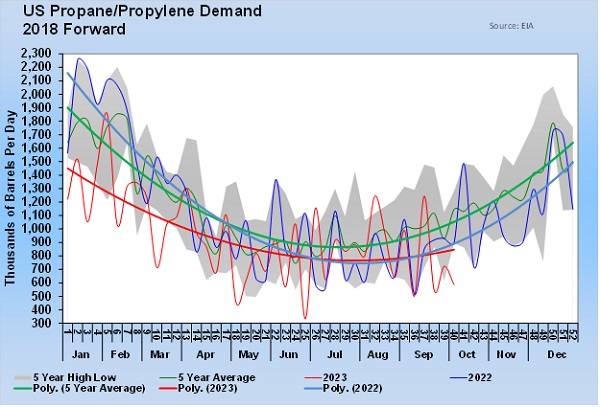

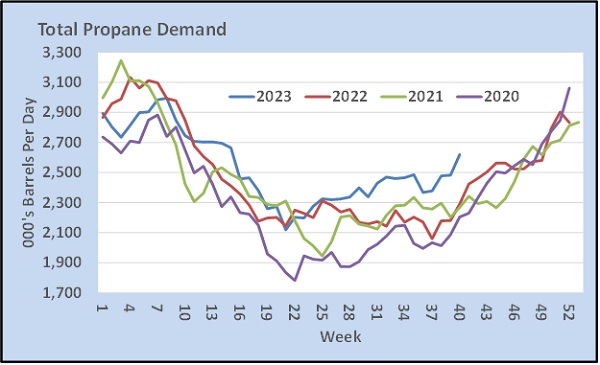

Chart 2 is domestic propane. It was extremely low at the beginning of the year. As we predicted, it recovered during preparation for this winter and, by June, was trending above last year’s rate. But now that much of the preparation for winter is complete, domestic demand is once again trending below last year.

Remember that the demand number in Chart 2 is a calculated number. The U.S. Energy Information Administration does not collect data on domestic demand. Instead, it collects data on propane imports, exports, production and inventories. It then infers what demand must have been based on the other data points. If the data is off in other areas, it skews the domestic demand number as well. We often see a huge jump in exports, resulting in a corresponding fall in domestic demand and vice versa. That is why we focus on the trend lines in Charts 1 and 2 rather than the weekly numbers. Combining export and domestic demand is useful as well.

Even with the low domestic demand, the high export rates mean overall demand is higher than the past few years. This supports the argument against being too bearish about propane prices.

A key question to ask when considering the future price of propane is: Why are exports so high, and are there reasons they could fall? A key reason the demand for U.S. sourced propane is high is that OPEC+, especially Saudi Arabia, is cutting crude production. Cutting crude production also cuts propane supplied when that crude is refined. When Saudi Arabia and other OPEC+ producers end some or all of their production cuts, propane supplies will also increase. When that occurs, it should take some of the pressure off of U.S. propane exports.

The other thing to note is that the growth in propane demand is almost all related to the petrochemical industry. Most of the growth in demand is coming from new propane dehydrogenation plants. Those are mostly in China, with around 14 new plants scheduled to come online this year. Those plants turn propane into propylene, which is used in the plastics industry. The demand for plastics is directly related to the health of the global economy. There is a lot of concern about the global economy, which is why crude prices had been falling before the situation in the Middle East developed the first week of October.

Those economic concerns remain. If the situation in the Middle East is contained, it is very possible crude prices will go down again until traders are more confident in the economy. A weaker economy would also hurt the demand for plastics, which would in turn lower the demand for propane.

We do know that propane inventories are at record highs to start winter and that U.S. propane production is also at record highs. Beyond that, most of what we have discussed are highly dynamic situations that make it hard to predict an outcome and any type of speculation in propane risky. Propane prices are still relatively low. Winter can be hedged for less than last winter could have been hedged at this time in the year. But a hedge means the buyer has a known corresponding sell at a known sales price against the supply purchase.

Speculation means we don’t have the sale side wrapped up. When retailers speculate, they are at risk of falling prices. If they have fixed too much supply cost with little flexibility to buy at spot in the winter should prices fall, a difficult competitive environment could develop. So, if you are considering speculating, leave some room to buy at spot this winter just in case our conservative view of things develops.

Weigh metrics like record high inventory and record high production against factors like crude price support, economic support and weather support. The first two are known, but the impact of the final three is not. Further, it seems when the market gets worked up about geopolitical events, and we make propane buying decisions for future supply in the midst of them, those situations are more likely than not forgotten by the time we sell our propane.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.