Revisiting the state of crude prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, revisits the current state of crude prices through 2024.

Catch up on last week’s Trader’s Corner here: The latest factors impacting propane demand

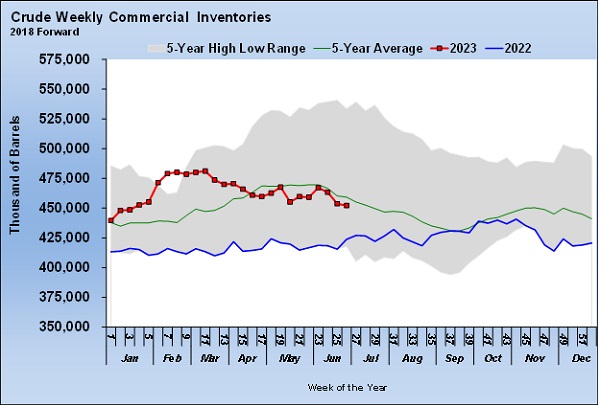

Through the month of July, we wrote a four-part series on the state of crude. In the first part of that series, we included Chart 1.

Then we wrote the following:

“Chart [1] shows U.S. crude inventory. The surplus that was present at the beginning of the year, that was helped by the massive releases from the Strategic Petroleum Reserve (SPR), is eroding away. Inventory started coming down once those releases went away. The resumption of smaller releases since May has not prevented inventory from trending lower. U.S. demand for petroleum products is stronger at this point in the year than it was at the beginning. Refinery capacity is up, so the ability to chew up more crude is present. As we pointed out above, the pressure on inventories could accelerate starting in August.

In our view, the massive release from the SPR provided a false sense of security concerning crude supply. One must be concerned that, without those releases, the inventory trend will continue toward last year’s line. In July of last year, crude prices were at $100 per barrel. We are hopeful we will not get anywhere near that price this year. However, you can see from all we have discussed above why we believe that crude’s price is more likely to increase from where it is now than decrease.”

When we wrote that article on July 10, WTI crude closed that day at $73.86. As we write today, WTI crude just traded for $87.45 per barrel.

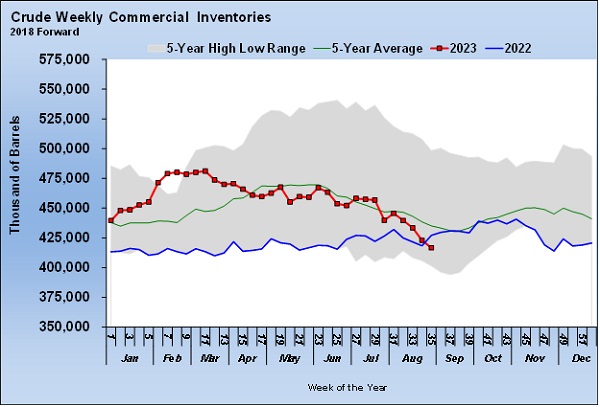

Chart 2 is where crude inventories stood when the U.S. Energy Information Administration collected data for the week ending Sept. 1.

WTI crude has indeed broken below last year’s level and remains in a sharp downtrend. Again, when we wrote that article on July 10, Mont Belvieu ETR propane closed at 59 cents per gallon.

We closed that article that day with this statement:

“Remember, the last two times propane was valued where it is currently, crude was trading at $45 per barrel. If our prediction that crude will remain above $70 going forward holds up, the pressure to improve propane’s value relative to crude will be acute. That means a little improvement in propane’s fundamental conditions likely will have an oversized impact on its pricing. A resumption of the above-average propane inventory build would prevent that from happening, but more upside price risk is currently present than we had been seeing.”

At close on Sept. 7, Mont Belvieu ETR propane traded at 74.5 cents per gallon. Crude has increased $13.01 per barrel, 18 percent since that July article was written, while propane’s price is up 15.5 cents per gallon, a 26 percent increase. Propane’s inventory position is currently setting five-year highs for this time of year, while crude’s inventory is rapidly heading toward five-year lows. Yet propane has outpaced crude higher. Even though propane inventories are high, the rate of the builds in inventories has slowed from where they were coming out of last winter. That slowing has been just enough to cause the gain in propane’s prices to be greater than the gains in crude.

But, make no mistake that the bulk of the gains in propane’s value are directly related to the rise in crude’s price. If crude’s inventory was going down and refined fuels inventories were going up, the situation for crude might not be so bullish. However, that is not the case.

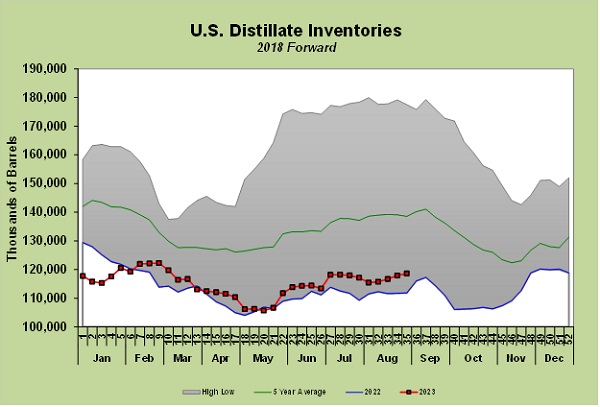

Distillate inventories, including diesel and heating oil, are near last year, which set new five-year lows for the entire year. There has been a lot of demand for distillates worldwide as Europe has been using it for electrical power generation after losing natural gas supplies from Russia.

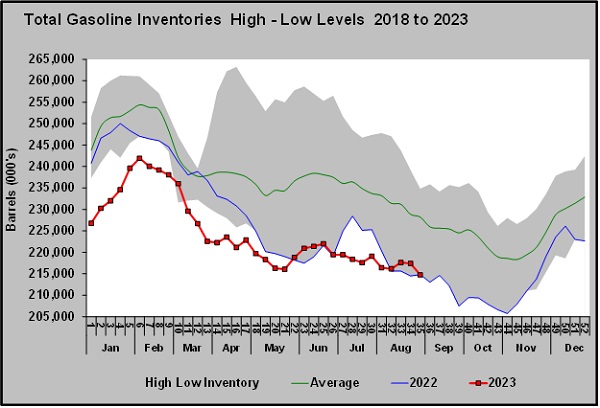

Gasoline inventory is right at last year and near a five-year low.

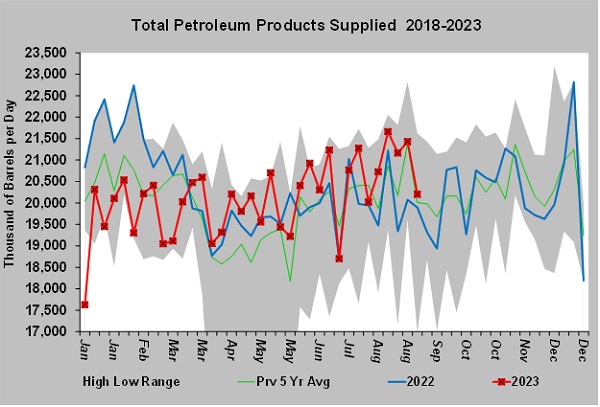

And despite high prices, the demand for all petroleum products has been strong recently.

Total petroleum products demand was relatively low at the start of the year, but since March, it has been strong. For the year, demand is running 202,000 barrels per day (bpd) below last year, but since March, it is running 507,000 bpd higher.

If the drawdown in crude inventories were leading to a buildup in refined fuels inventories, or if there were signs that demand for petroleum products was declining, one might feel the situation with crude is less ominous. But, as we said, that is not the case.

Of course, it’s a global market for crude, and demand destruction could be worse elsewhere. But OPEC+ has aggressively cut its production to support crude prices, so it will take a significant collapse in demand for the upward pressure to come off crude’s price. Saudi Arabia announced last week it is extending its voluntary million-bpd production cut through the end of the year. This cut is in addition to its reduced production quota agreed to as part of its cooperation with other OPEC+ members. This announcement has allowed crude to break free of the $80 WTI price level we thought it might hold at for a while longer.

Crude prices are once again in a strong uptrend, and we are still waiting to see where it may end. If crude prices are rising, there will be upward pressure on propane’s price. But, as we pointed out last week, propane fundamentals are not supportive of its price, and there are reasons to believe the recent improvements in propane demand could run out of steam once preparation for winter is done. There are threats to domestic propane demand for this winter with El Nino conditions and weak crop drying probable. But, at least right now, it looks like higher crude prices could limit any downside for propane prices and could keep its price on the rise in the short term.

Catch up on the rest of this Trader’s Corner series here:

- Part I: Evaluating the state of crude prices

- Part II: Evaluating the state of crude prices

- Part III: Evaluating the state of crude prices

- Part IV: Evaluating the state of crude prices

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.