What lower crude demand in the US means for propane retailers

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains what lower crude demand in the United States will mean for propane retailers.

Catch up on last week’s Trader’s Corner here: Solving the mystery of propane forwards

Last Thursday, the Organization of the Petroleum Exporting Countries (OPEC) and cooperating producer nations, known as OPEC+, decided to take more crude off the market to support crude’s price. If they follow through with the plan, they will be producing around 6.2 million barrels per day (bpd) below their benchmark production rates. That was the crude production rate established before any production quotas were put in place.

OPEC+ has established individual quotas for each member country so that they share proportional to their production in efforts to support crude’s price. The quotas shared by the members reduce their combined output by around 4 million bpd. Since July, OPEC’s largest producer, Saudi Arabia, has voluntarily cut its production an additional 1 million bpd. OPEC+ member Russia joined it by reducing exports by 300,000 bpd. So, theoretically, since July 2023, OPEC+ has been producing 5.3 million bpd below benchmark rates.

At the latest OPEC+ meeting, the quotas remained the same, and Saudi Arabia extended its voluntary cut through March 2024. Russia raised its voluntary cut to 500,000 bpd, and other OPEC+ members pledged to voluntarily cut an additional 700,000 bpd from production. Therefore, the total reduction in output is made up of around 4 million bpd from quotas and 2.2 million bpd from voluntary cuts.

OPEC+ is making these cuts because it is concerned that the world is going to need less crude, and if they don’t reduce production the price of crude is going to tank. Data shows that the global economy is slowly reducing energy demand. There are concerns that the weakening economic activity will continue throughout 2024. Some believe that by May of next year the U.S. Federal Reserve will need to start reducing interest rates again to help stimulate economic growth.

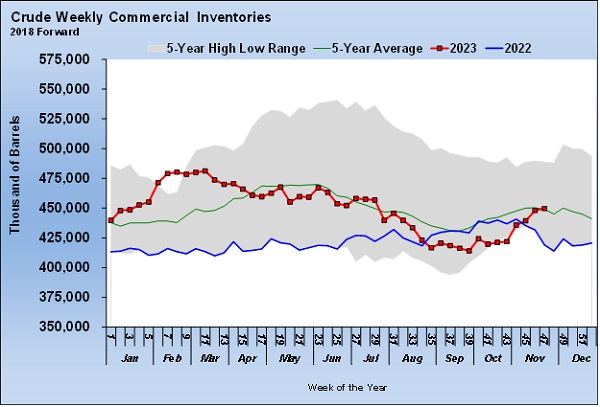

In this Trader’s Corner, we are going to look at some trends in U.S. data that will provide a picture of how U.S. demand is running. Before we look at the demand side, let’s look at the recent trend in U.S. crude inventories.

U.S. crude inventories have been rising rapidly over the last few weeks, leading to the downward pressure on crude prices. Weaker crude prices generally lead to lower propane prices, especially when propane fundamentals are not supportive. U.S. crude inventories have gone from setting a five-year low to above the five-year average in a matter of four weeks.

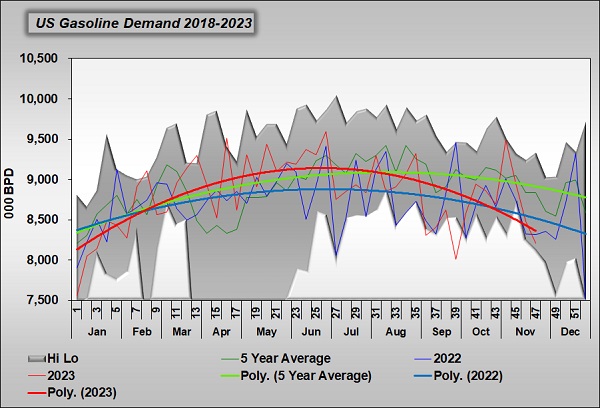

A key driver on the demand side is gasoline.

Weekly gasoline demand numbers can be erratic from week to week, so we focus on the trend lines, which we have made bolder in Chart 2. U.S. gasoline demand was running above trend from February through July. Since then, demand has fallen sharply and is running below trend and last year. The seasonal pattern is for demand to fall this time of year, but the decline this year is significantly more than usual.

Regular readers of Trader’s Corner know we have expressed concern about propane demand this winter. One of the factors is the financial stress that U.S. households are feeling. The U.S. economy and labor market shook off the tighter monetary policies of the U.S. Federal Reserve for far longer than most expected. Inflation, high debt and much higher interest on debt have finally ground down the resolve of the consumer. We believe that is reflected in the demand numbers in Chart 2.

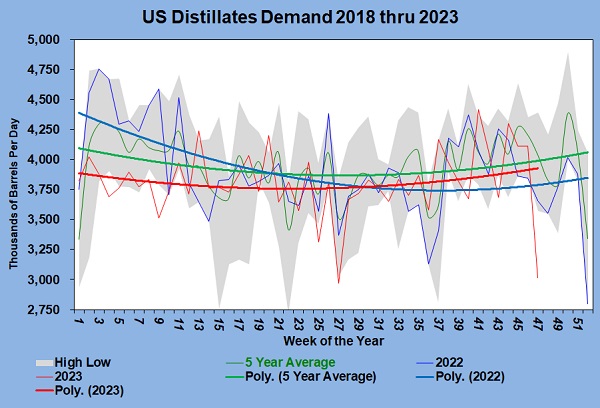

Distillate demand, which is a good indication of economic activity, is also running below trend.

Distillate demand has been running below trend all year. Demand was well below last year for the first half of the year but is beating last year now. Still, the overall demand for distillates has not been strong this year. Strong export demand for distillates has caused the price to be very high in the U.S., hurting demand.

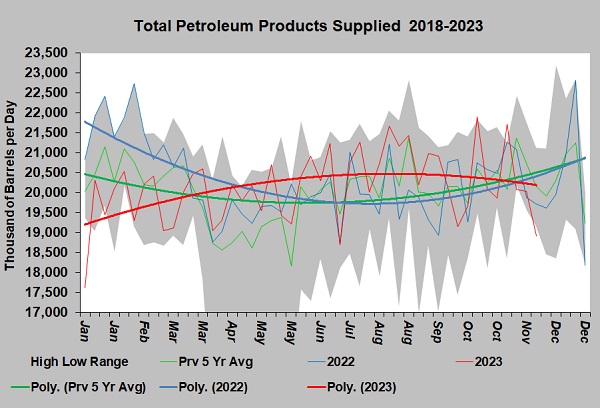

Total petroleum products supplied is the demand for all products made from crude.

Demand was strong through the summer but recently fell below trend and last year. It is this trend that OPEC is trying to stay ahead of with all of its production cuts. It sees weak economic conditions causing a slowdown in demand. It is trying to boost crude’s price by assuring that supply stays even with or below demand.

We could argue that OPEC+ is doing exactly the opposite of what it should be doing. For more than two years now, it has been lowering production to raise the price of crude. Yet, the high price of energy has been a key component of inflation. Central banks have been raising interest rates to cool inflation. Essentially, the decisions of OPEC+ and central banks have been at odds with one another. Combined, they are crushing the consumer and thus energy demand.

In our view, had OPEC+ allowed crude and overall energy prices to fall, it would have reduced inflation and resulted in fewer interest rate hikes by central banks. We believe the economic downturn and the resulting recovery may well have been ahead of where it is now had OPEC helped consumers by allowing energy prices to cool along with the economy.

Not long ago, OPEC was saying that $60 crude was fair for both producers and consumers. Yet, its reduction in production has come with crude prices over that mark. WTI crude averaged $70.32 per barrel, and Brent was even higher during June when Saudi Arabia made its decision to implement the million-bpd voluntary production cut and Russia added its 300,000 bpd in cuts. By September, WTI averaged $89.43 per barrel. Yet, Saudi Arabia and Russia continued making voluntary production cuts. Crude averaged $77.38 in November, still well above a price that should be fair for producers and consumers, yet OPEC+ has now doubled down on reducing production.

What makes this situation even more perplexing is that high crude prices play into the hands of producers that get crude from higher-cost shale formations. OPEC allowed crude prices to tank to bust those producers several years ago. The effort was just as devastating to OPEC+ as it was to producers of crude from shale formations. OPEC+ had to back off flooding the world with crude for its own economic survival. It got bailed out by the pandemic, which harmed shale producers and finished the job OPEC+ had started but couldn’t complete.

With the help of the pandemic, OPEC+ finally had shale producers in their place. U.S. producers were holding the line on production, and OPEC+’s market share was increasing again. But now it is reducing production, opening the door for non-OPEC producers to gain market share.

Saudi Arabia and Russia have been thick as thieves since OPEC+ was formed. At the onset of their voluntary cuts in production, it felt like their efforts were aimed at keeping crude prices elevated for Russia’s sake to help generate revenues for its war effort against Ukraine.

Of course, the Saudi crown prince will smile and say that politics is not a factor in his country’s crude production policies. He says it is all driven by market conditions and the need to keep crude prices fair for producers and consumers. Then why cut production and exacerbate inflation when prices were already well above what OPEC+ and Saudi Arabia have said is a fair price for consumers and producers?

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.