What in the world? The influence of US propane exports

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Wednesday, March 27 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, delves into the impact of propane exports on the recent price increases.

Catch up on last week’s Trader’s Corner here: Breaking down the new propane inventory number

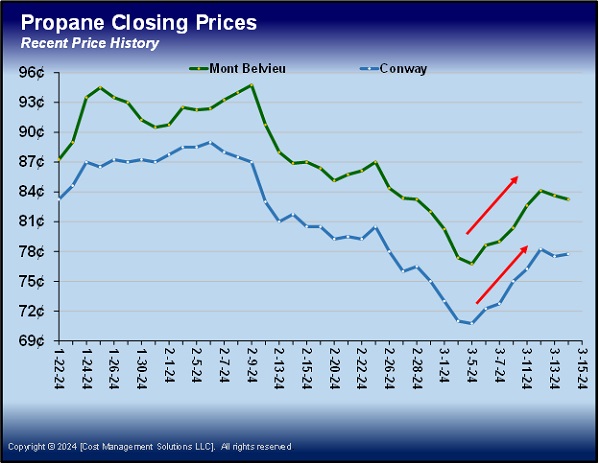

Propane recently had an uptick in prices at both Mont Belvieu and Conway. As Chart 1 shows, propane prices had risen sharply due to both increased demand and supply disruptions during January’s winter storm. But after the impacts of the storm eased and temperatures moderated, propane prices went into a several-week downtrend. Then, suddenly, without any significant change in weather and the end of winter demand even nearer, a significant bounce in prices occurred. What in the world?

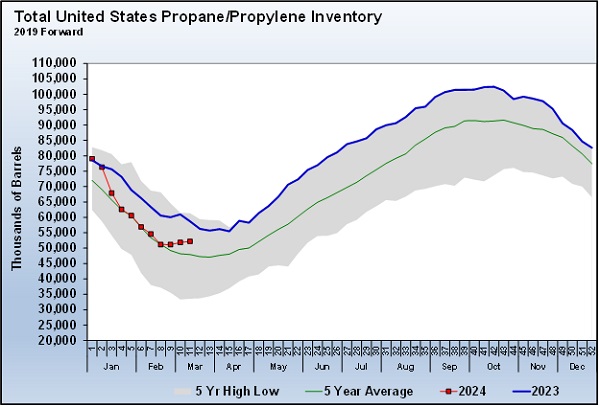

At the same time propane prices were making their abrupt turn higher, U.S. propane inventories were also rising, as shown in Chart 2.

Why in the world would a sharp rise in propane prices occur at the same time a sharp rise in propane inventories was occurring? Shouldn’t propane prices fall when inventories are rising? Perhaps the word “world” is a clue.

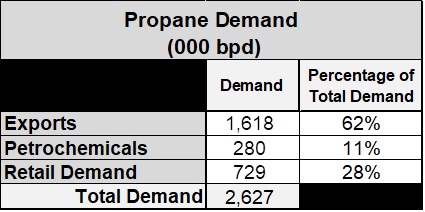

There was a time when there would have been a direct correlation between inventories, seasonal demand and prices. But more and more, there is a disconnect between the season, inventory positions and pricing. Chart 3 helps us understand why.

U.S. retail propane demand is now only 28 percent of total propane demand. A generation ago, retail propane demand was the market. During those times, there was a strong correlation between season, inventory position and pricing. Back then, the export category didn’t exist, and retail propane demand was about 70 percent of total demand. During that time, it was much easier for someone in the retail propane business to understand the correlation between demand and pricing. With exports now 62 percent of overall U.S. propane demand, it is in the position to influence the market the way retail demand used to impact pricing.

With this background, let’s go back to the recent rise in propane prices that went against traditional or conventional thinking.

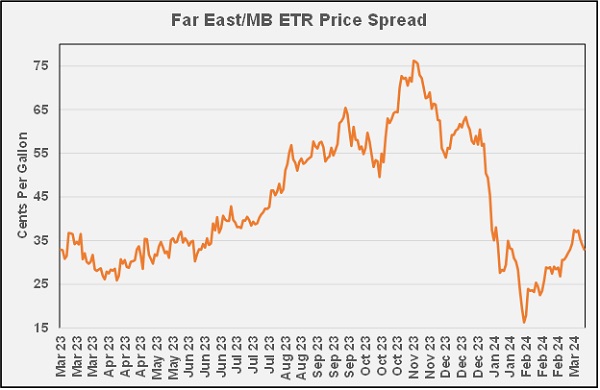

Chart 4 shows the price spread or the difference in the value of propane between Mont Belvieu, Texas, and Far East markets. Last year, the spread became very wide, which tends to encourage exports. When the spread dropped to near 15 cents, the cost of exporting was exceeding the return, helping to keep more propane at home.

But as the spread started to improve again in February, foreign buyers became more active in the U.S. market, and more cargoes started moving out of the U.S. As foreign buyers bought the propane they needed to fill tankers, the price of propane increased.

So, the price increase had little to do with U.S. weather or the U.S. propane inventory position at all. It had to do with an uptick in global demand for U.S. propane that increased prices overseas relative to the U.S. market and “opened” the export window. As the price in the U.S. has increased, we can see in Chart 4 that the spread is coming down and, consequently, we can see in Chart 1 that U.S. propane prices have flattened out.

During this generation, U.S. propane has become a global commodity. Retail propane demand is declining every year as a percentage of total U.S. propane demand. Consequently, the seasonal patterns and correlations that we used to rely on are not as distinct as they once were. Because there are more global influences on U.S. propane prices, it is more difficult to predict price movement and price patterns.

We must adapt, and that means being more focused on our market and what we can control. That means setting benchmarks based on our own pricing history. When the market gives us an opportunity to hedge future supply at prices that are near our benchmarks, we should take advantage. Let our competition try and figure out the global propane market. Let’s focus on the prices we need to be a consistent, steady supplier of fairly-valued propane in our world, and let’s leave the rest of the world to everyone else.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.