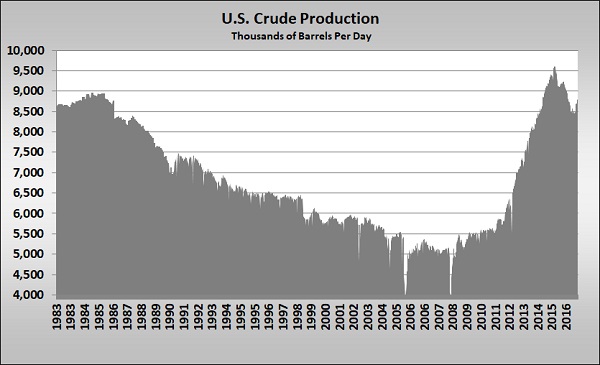

Can the US stop Russian energy imports and supply Europe?

March 8, 2022 By Mark Rachal

Mark Rachal, director of research and publications for Cost Management Solutions, examines the U.S. energy position in light of the events in Ukraine.

Read More

Mark Rachal, director of research and publications for Cost Management Solutions, examines the U.S. energy position in light of the events in Ukraine.

Read More

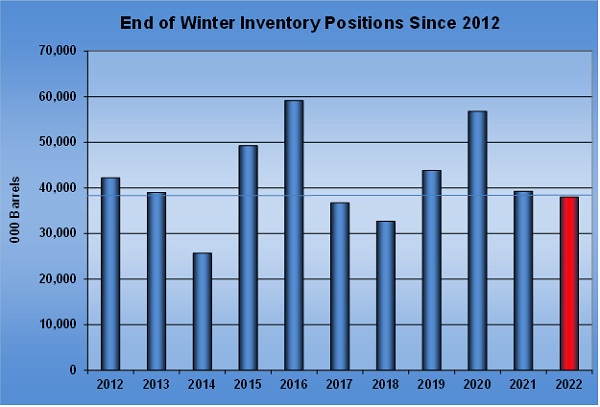

Mark Rachal, director of research and publications for Cost Management Solutions, examines why propane inventory is getting tighter.

Read More

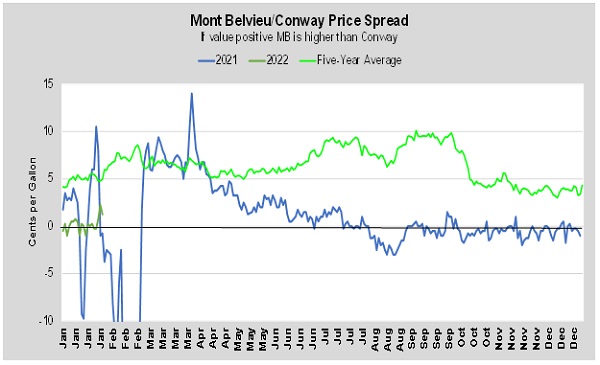

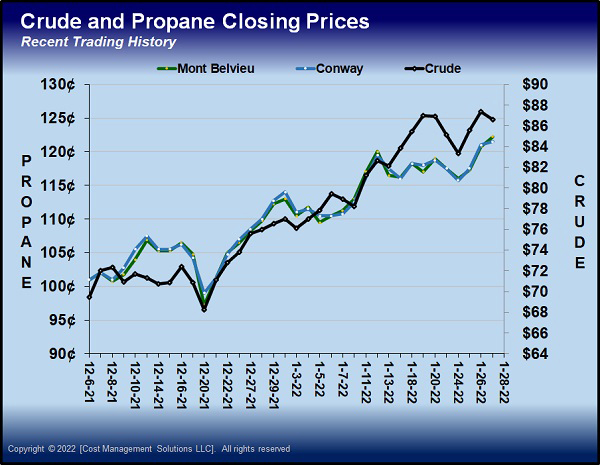

Mark Rachal, director of research and publications for Cost Management Solutions, examines why prices between Mont Belvieu and Conway are closing.

Read More

Mark Rachal, with Cost Management Solutions, addresses propane prices and explains how to set expectations for next winter.

Read More

Mark Rachal, director of research and publications for Cost Management Solutions, addresses propane prices and makes comparisons to conditions in 2014.

Read More

As things stand now, which is what we must base decisions upon, it is looking more like an entry point to hedge winter propane anywhere sub-dollar is feasible.

Read More

Amid volatility in propane prices, Mark Rachal of Cost Management Solutions explains the difference between two financial tools: swaps and physicals.

Read More

EIA data shows that propane demand exceeded supply, resulting in a 10-million-barrel draw in propane inventory. That helped support higher propane prices.

Read More

Mark Rachal expands an analysis of historical market trends to determine guidance on where propane prices might start during next winter.

Read More

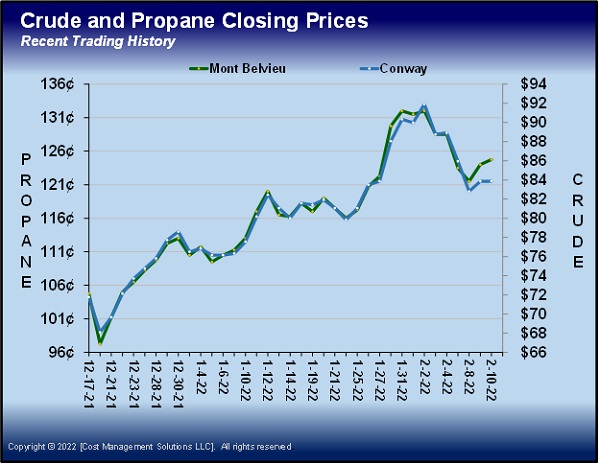

Mark Rachal of Cost Management Solutions provides pricing data to help propane retailers strategize for the rest of winter.

Read More