Does threat or opportunity win in your propane-buying plan?

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Wednesday, May 29 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses opportunities and guarding too closely against possible threats when it comes to buying propane supply.

Catch up on last week’s Trader’s Corner here: Clash of the titans: Propane production and exports

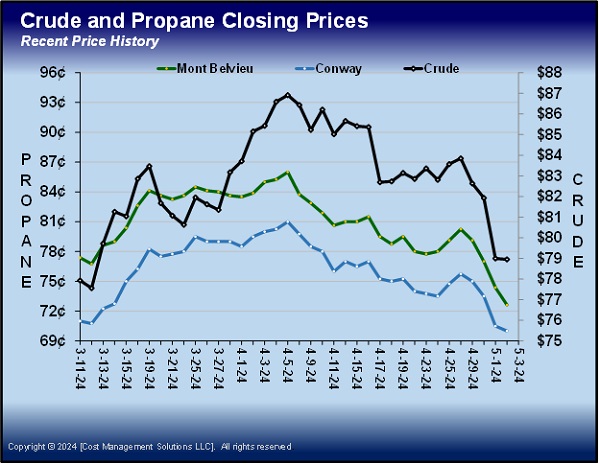

We want to take you back to the Trader’s Corner written on April 12 and released on April 15. It was entitled “Looking forward to next winter and beyond.” On the day that article was written, Mont Belvieu ETR propane closed at 81 cents and Conway at 77 cents. They had closed at 86 cents and 81 cents, respectively, one week before.

We made the following statement, “With the recent pullback in prices, values look better for the winter of 2024-25 but still a little pricey. Pricing for the further-out winters looks better.”

Later in the article, we said, “Nevertheless, between now and the end of June, we should expect some of the best propane values based on history. Over the past five years, front-month propane has averaged around 74 cents during May and June. April has averaged around 78 cents, so the odds favor putting our plans together over the next couple of weeks and begin executing them in the upcoming couple of months.”

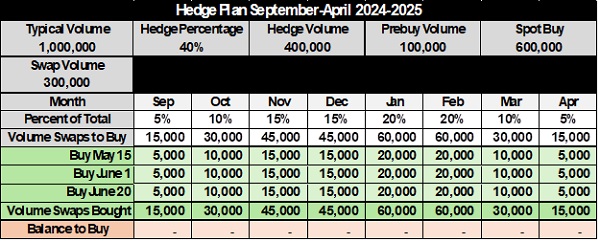

In that article, we went into a lot more detail about the thought process that goes into a hedging program and used Chart 1 to illustrate how that might look.

Note in Chart 1 that we were buying in May and June to fill our hedging goals for September through April.

It has been fortuitous for buyers over the past few weeks since that article was written that propane prices have continued to fall. As we write on Thursday evening, May 2, Mont Belvieu ETR propane just closed at 72.625 cents and Conway at 70 cents. These values are all over where May and June have averaged during the past 10 years, so we know we are in a much safer buying zone.

Hedges made two weeks ago would have been paying a premium to the 10-year average propane price for most months. But now, as we look out over the next three years, there are only a handful of months where that would be the case.

In addition, propane has fallen under its 200-day moving price average. History suggests that buying when that is the case greatly increases the chance of the hedge being favorable. Further, propane’s value relative to WTI is at or below the lowest we have seen for this time of year going all the way back to 2001. Generally, buys made when propane is valued low relative to WTI have a greater chance of being good.

We pointed out in recent Trader’s Corners that this downturn in prices has been aided by strong propane production and a drop in crude’s price. Propane inventories are near five-year highs largely due to the surge in production. Production came down just a little during the week ending April 26 after setting new records two weeks in a row. Still, it is a robust rate, and with inventories already high such a high rate could very well lead to propane inventories setting five-year highs in upcoming weeks.

So as good as the past two weeks have been for buyers, there could be more downside for prices, so that is why layering in supply as in the example above is a good idea.

We also shouldn’t underestimate the impact of the sharp fall in crude’s price since April 8 on the favorable prices we now see in propane. Propane’s turn lower exactly corresponds to the decline in crude’s price.

Crude has been tumbling on concerns for the global economy and more recently because Hamas and Israel are at least considering terms for a ceasefire again.

A part of the economic concern was an uptick in inflation. It appeared inflation was under control at the start of the year, and for several months the expectations grew that the Federal Reserve would start lowering interest rates in June. Then inflation ticked up, and the Fed took the June rate cut off the table. Subsequently, there was another round of concerning inflation causing speculation that the Fed could raise interest rates even more. That caused more concern for energy demand and became a heavy weight on crude’s price.

At the conclusion of today’s (Thursday, May 2) Federal Reserve monetary policy meeting, Federal Reserve Chairman Jerome Powell was asked if the Fed could raise rates. He suggested strongly that the next rate change is far more likely to be a cut, though he acknowledged that such a cut will come later than the Fed had expected. That statement all but took a rate hike off the table. It caused a big bounce higher in U.S. equities markets. Crude markets did not respond much, but we are betting when we wake up in the morning (Friday) that crude prices will be up.

If crude starts a rally on this development and then ceasefire talks between Israel and Hamas break down, crude will likely retrace some of its recent decline since those two factors are largely responsible for it. A rally by crude would likely pull propane prices out of their decline as well. If these things should come to fruition, a propane buyer might want to get that first layer of price protection before the opportunity that has been presented over the past two weeks evaporates.

Again, we are acknowledging that propane fundamentals are not supportive with the high production and already-high inventories, so we probably don’t want to be overly aggressive, but we also don’t want to let this dip get away without our full consideration of whether it is the right time to take that first layer of supply for next winter or even beyond.

On the one hand, there are a lot of good-buy signals for propane. A lot of the boxes are checked, which increases the odds that buys will be favorable. When that is the case, we simply shouldn’t ignore the opportunity. Yet, we must be cognizant that propane fundamentals could become even less supportive of propane’s price. We need to manage that possibility by layering in supply during the buy window through June. And if fundamentals are weak enough, the buy window could stay open beyond June, which is more reason to layer in our price protection over time and also leave plenty of volume to be bought at market prices come winter.

As buyers, we should always be monitoring developments that will affect crude’s price and propane’s fundamentals and let those developments guide our degree of aggressiveness. How inventories are likely to trend building up to winter should become clearer over these next two months.

But we simply can’t let the fear that prices could go lower dictate our every decision, because that possibility will always be present. If that fear drives a buyer, then many, many good buying opportunities will pass by. None of us can know the future, and the unknown always feels threatening to any decision we make in the present. We know opportunities when we see them in the present. If we don’t act on them, we often don’t get them back in the future. But, the truth is, most of us are driven more by unknown future threats than known current opportunities.

Mostly it’s because we fear being wrong. But what we have witnessed so many times over the years has been that those who let fear prevent them from taking advantage of opportunities will at some point find themselves in a rising market. They will assume their competitors took advantage of the opportunities. That fear will often cause them to buy at exactly the wrong time, at the top of the market.

Guarding against giving too much weight to unknown threats and not enough weight to known opportunities has a better-than-equal chance of improving our rate of success.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.