Potential end-of-winter inventory positions

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates possibilities for inventory at the end of winter 2023-24.

Catch up on last week’s Trader’s Corner here: Weak propane prices expected despite strong export activity

In last week’s Trader’s Corner, we focused on the fact that propane inventories were at a record high for the beginning of October – considered the start of the winter heating season by most. This past week, inventories continued to build, outpacing expectations with an 806,000-barrel gain that took them to 102.320 million barrels. The gain put inventories near the record high of 102.804 million barrels. The year that record high was set, inventories were at 94.054 million barrels to start October but continued to build through the third week of November.

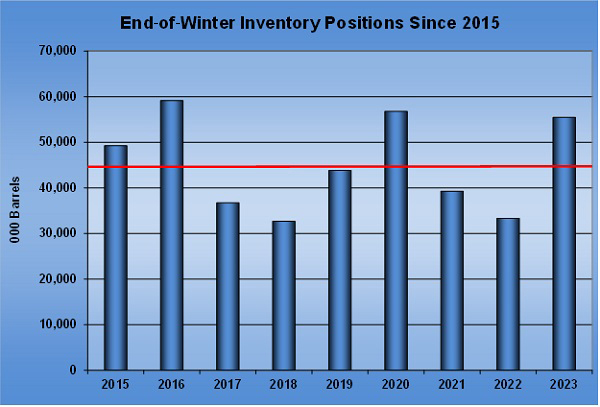

This week, we are going to look at history to estimate where propane inventories might be at the end of this winter in 2024. For context, Chart 1 is a history of end-of-winter inventory positions since 2015.

Since 2015, the end-of-winter inventory position has ranged from 32.671 million barrels to 59.118 million barrels. The average was 45.146 million barrels, with last year’s 55.456 million barrels the third highest over the period.

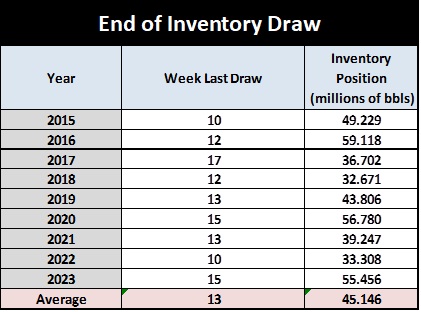

Chart 2 shows what week of the year inventories stopped drawing, which one could also call the end of winter.

On average, the low inventory position hits in week 12 of the year. So, for our study, we are going to calculate winter inventory changes by using the inventory position at the last week of September through the last week of March, which will encompass the inventory changes during the traditional winter period of October through March.

The highest inventory draw during the period occurred in the winter of 2020-21. The low case was last winter (2022-23). We used the average draw from 2015 forward for the base case.

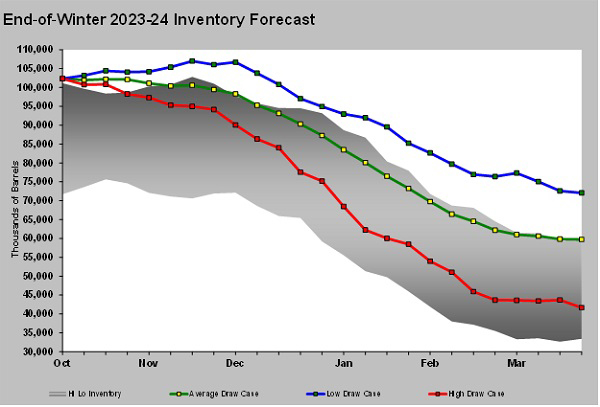

Let’s begin with the base, or average, case. Remember when we did the forecast on where the inventory build period would take inventories? The base case was almost right on the money. So, we want to give this case plenty of consideration for the drawdown as well.

The base case has end-of-winter inventories at 59.737 million barrels, which is just above the current five-year high set in 2016. At the end of March 2016, propane at Mont Belvieu traded at 44.125 cents. Crude was at $38.34 per barrel, making propane valued at 48 percent of crude, which is near the long-term average of 50 percent relative value to crude. By the first of October that year, propane traded at 55 cents. Crude was at $48.81 per barrel. That left propane at 47 percent of the value of WTI. Essentially, propane simply matched the gains made by crude that summer.

Next is the low inventory draw case, which is based on last year. Last winter, inventories only declined 28.683 million barrels. If that low-case scenario repeats this year, inventory would stand at a record 72.064 million barrels to start the next inventory build period. That would likely be bearish for prices.

At the end of March, propane was at 79.5 cents and crude at $72.97 per barrel. Propane was valued at 44 percent of crude. Currently, propane is at 70.625 cents and crude at $90.08, making propane valued at 33 percent of crude. Propane inventories were at 55.456 million barrels at the end of last winter. We can see that propane fell in relative value to crude because of propane’s weak fundamental support, including the high inventories coupled with crude having better fundamental support.

The high inventory draw case based on the winter of 2020-21 would draw inventory by 62.712 million barrels, leaving the total at 41.670 million barrels at the end of this winter. Even that massive draw would leave propane inventories right at the average of 41.741 million barrels since 2015.

In March 2021, at the end of that high-draw case, winter propane inventory stood at 39.247 million barrels. Propane was valued at 93 cents and crude at $61.56 per barrel, making propane 66 percent of the value of crude. That is well above the long-term average relative value of 50 percent. Propane had begun that winter at 49.25 cents, with crude at $38.72, putting propane at 53 percent of WTI.

By the start of the next winter, propane was valued at 149 cents, with crude at $75.88 per barrel, putting propane at 82 percent of WTI. We must remember that the COVID-19 pandemic began in the U.S. in December 2019, so the 2020-21 winter was influenced by extraordinary events. That makes repeating that year less likely.

As we stated before, our bias is toward the base to low-draw cases. Our reasons are based on the possibility of low domestic demand again this year. Low crop drying demand, likely El Nino conditions that could hurt heating demand in the high-consuming areas and a financially stressed consumer that will need to conserve are all legitimate reasons to be concerned about demand.

On the supply side, propane production is at record highs and climbing. That leaves propane exports to offset both lower domestic demand and high production as the only avenue to make propane fundamentals more supportive of propane’s price. Stronger fundamentals will be necessary to drive propane’s relative value to crude up from its currently low 33 percent.

The weak fundamental picture for propane and the prospect that only exceptionally strong exports will be able to change the fundamental picture has us seeing only high crude prices as the primary support for propane prices this winter. Again, this makes us cautious about speculating on propane. Hedging propane (buying supply against a corresponding known sale) is fine, but speculation in propane has a lot of risk.

If one wants to speculate, it would be better to simplify and take propane out of the equation. If indeed high crude is the likely reason for higher propane prices, why not just speculate on crude? A speculator needs to be nimble. The highly liquid crude market is much easier to move in and out of at favorable bid offer spreads compared to propane. So, one needs to be confident in a bullish market for propane to choose to speculate on it rather than crude.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.