Crude prices rise despite inventory build

March 9, 2021 By Mark Rachal

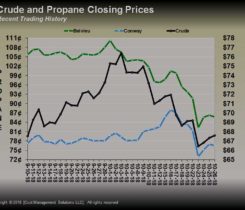

Along with tighter propane fundamental trends, crude trends point toward a higher price environment ahead, says Mark Rachal of Cost Management Solutions.

Read More

Along with tighter propane fundamental trends, crude trends point toward a higher price environment ahead, says Mark Rachal of Cost Management Solutions.

Read More

Normally, there is a fairly close correlation between the price direction of propane and crude, but sometimes they…

Read More

Developments in crude production and pricing should be watched carefully to see how that translates to propane production and pricing leading up to winter.

Read More

As citizens sheltered in place, there was a dramatic shift in crude demand, leading to an extreme oversupply that has most available crude storage nearing capacity.

Read More

In addition to crude’s collapse, Rachal discusses the propane pricing and supply environment. COVID-19 will have a greater impact on propane supply than it will on propane demand, he says.

Read More

While Saudi Arabia has called an emergency meeting of OPEC+, there is little doubt that U.S. production growth is very likely to slow in the future.

Read More

The price of crude has rebounded a little since, but the potential for it to go lower is still present due to demand destruction from COVID-19 and producers not cooperating to limit production.

Read More

October has turned out to be quite frightening for crude and propane bulls. The upward momentum that had been prevalent since April came to a screaming halt.

Read More

A report from the U.S. Energy Information Administration (EIA) examines U.S. propane’s relationship with world propane prices and crude oil prices.

Read More

Any forecast on propane prices begins with trying to determine where crude will be priced.

Read More