Weaker crude puts propane into counter-seasonal pricing trend

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates forecasts for crude prices this winter.

Catch up on last week’s Trader’s Corner here: Propane exports key to winter pricing

Leading up to the fall, there were plenty of forecasts for $100 crude sooner than later. By the end of September, WTI reached an intraday high of $95.03, and it felt as if $100 crude was only days away. As we write on Nov. 10, WTI was as low as $75.31, and just a couple of days ago fell to $74.61.

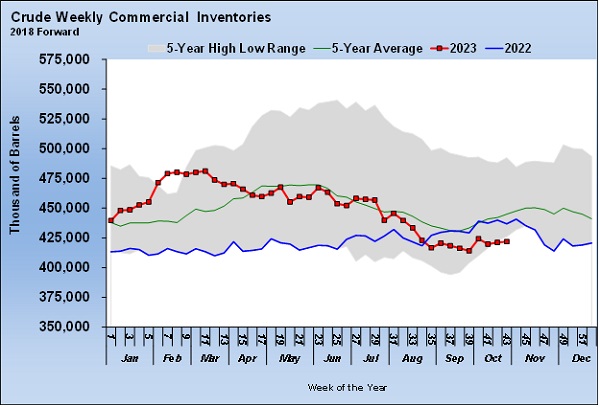

With propane fundamentals not supportive of propane’s prices, a bullish pricing case for propane generally depended on higher crude prices. If we just look at the U.S. crude inventory, one would think the bullish case for crude would still be in play.

Currently, U.S. crude inventories are setting a five-year low for this time of year.

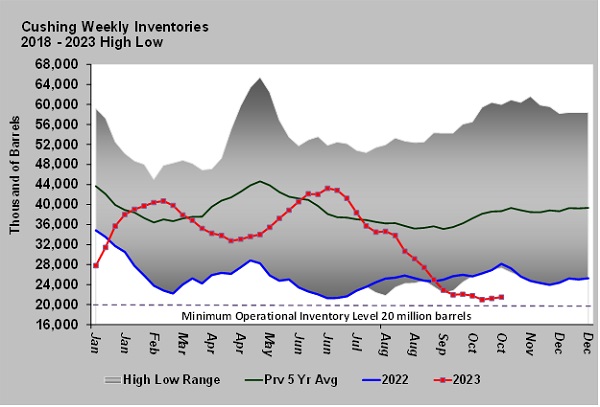

Critically, crude inventories at the U.S. trading hub at Cushing, Oklahoma, are hovering just above their minimum operational inventory level. Inventory levels at Cushing have an oversized impact on the market because of its significance in trading as well as supply distribution.

Yet, WTI crude is down 21 percent from its September high. Consequently, at a time when propane prices are normally rising at the beginning of the heating season, they have been falling. Propane has lagged the fall in WTI, having seen a 14 percent decline in value over that time. Nonetheless, the fall in crude has been enough to put propane prices into a counter-seasonal pricing trend.

Crude has remained in its downtrend despite the war between Hamas and Israel starting in the middle of it. That war offers some risk to crude supply from the Middle East. Though prices initially rebounded when the war started, concerns about the war spreading in a way that would disrupt crude supplies have faded.

As bullish support for crude prices has faded, there have been numerous bearish drivers stepping in to fill the void. During this downtrend, the value of the U.S. dollar has improved relative to competing currencies. In July, the dollar index stood at 99.842. By Oct. 3, it had reached 107. The rise generally came on the expectation the Federal Reserve would resume interest rate hikes. The index has fallen in recent days because the Fed did not raise rates, but still stands at 105.910. The strong dollar makes crude more expensive for those using other currencies, thus hurting demand.

Economic data has raised concerns about crude demand. Economic activity in China, Europe and the U.S. has slowed. Manufacturing activity in those countries has fallen into contraction. Because of the weaker economic conditions, the U.S. Energy Information Administration (EIA) just lowered its global growth in crude demand for this year by 300,000 barrels per day (bpd) to 1.4 million bpd.

Meanwhile, the EIA is estimating U.S. crude production at a record 13.2 million bpd. Some question the validity of that number since production from shale formations, the largest growth area for U.S. crude supply, has fallen over the last four months, and drilling activity continues to decline. Regardless, U.S. production has improved to be at least near the pre-pandemic highs.

A key support for crude has been all the production cuts made by OPEC+. Its members have pledged production cuts totaling about 3.7 million bpd. About 2 million bpd of those cuts have been pledged since April.

However, a report by Goldman Sachs says the six largest OPEC+ exporters have only reduced crude exports by 600,000 bpd since April. The producers could be meeting production targets using inventories and reduced domestic demand to keep exports up. Regardless, the net result is the world is getting more crude from these suppliers than expected when the production cuts were announced.

Crude supplied from Russia and Iran has been robust despite price caps and sanctions against those countries. Russia has found buyers, mostly India and China, for its crude despite the sanctions, and, frankly, the world is generally happy to see it flow even though it gives Russia the revenue to conduct its invasion of Ukraine.

The U.S. chose not to enforce sanctions against Iran, hoping to bring down energy costs. In that same vein, the U.S. has recently negotiated deals to allow more crude from Venezuela to flow freely into the marketplace. The U.S. needs the heavy crude from Venezuela, and the U.S. provides Venezuela with the highest netback for its crude.

Last week, there were reports that talks have resumed to open the pipeline from Kurdistan to Turkish ports. The line has been down since March, taking about 450,000 bpd away from global crude supplies. It has been down for geopolitical reasons, so it is hard to know if the talks will be successful, but, if they are, it would be a major positive for crude supplies. Just the possibility is a headwind for crude’s price.

Combined, there are a lot of headwinds for crude. Does that mean its price is destined to continue lower? Many don’t think so, and we tend to agree. The current price of around $75 is seen as a likely low point for this downward correction. We will admit that anything below that seems like an overcorrection.

Over the last couple of days, there have been enough interested buyers at around the $75 mark to at least halt the decline in crude prices. However, a halt in the decline does not necessarily mean a major recovery in prices is about to occur.

In the first quarter, there will be seasonal maintenance by refineries in preparation for the high gasoline demand in the summer driving season. That will reduce refinery throughput, which would be yet another headwind for crude. But there is a long way to go to that point. Some of the other headwinds for crude mentioned above could be gone by the time refinery maintenance starts. And, of course, new bullish drivers could be in play by then as well.

The weak fundamental support for propane prices made a strong crude market essential for those speculating on propane prices. This rather unexpected weakness in crude’s price has certainly hurt any propane speculative positions to this point. However, there is a good chance the worst may be behind those that are long propane if $75 does turn out to be a floor for crude. A 21 percent downward correction that is already in the books for WTI is significant and certainly smacks of an overcorrection if it continues.

This pullback also represents a reduced-risk opportunity for new propane buyers. However, even if crude has stabilized here, and even if it should go higher, significant threats remain to propane speculative long positions. We have spent many of the recent Trader’s Corners exploring those threats and recommending caution.

We would be especially cautious about the second half of this winter, given the high inventory positions and concerns for propane demand. The better plays for propane might be the longer-dated, further-out positions, giving more time to reduce propane inventory positions and allow for a recovery in crude’s price.

We still like propane hedges (buys backed up by sales) simply because propane is valued so low and should be well received as fixed-price offers to consumers. But it is hard to feel confident in any near-term speculation for propane. Record-high inventories and prospects for weak domestic demand tend to do that for us. We need to see sustained above-average draws on inventory to gain confidence in that endeavor.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.