Propane exports key to winter pricing

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines various propane export scenarios that could happen this winter.

Catch up on last week’s Trader’s Corner here: Propane is a cheap Btu

Propane exports are going to be key to how this winter plays out from a pricing standpoint. That may sound like an odd statement given that weather and heating demand would logically be the key drivers this time of year.

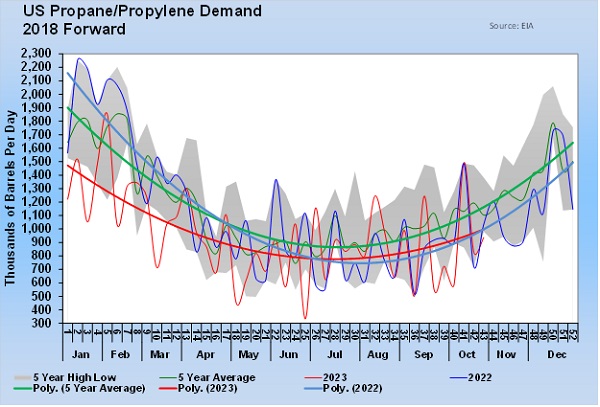

Over the past five years, propane demand has averaged 1.452 million barrels per day (bpd) from the first week of November through March. This past winter, demand during the same period ran 1.382 million bpd.

As Chart 1 shows, demand was very weak in the second half of last winter. In July, demand moved above the previous year but is now back on the previous year’s trend line.

In recent Trader’s Corners, we have expressed concern that U.S. domestic demand will be weak again this winter. We point to weak crop drying demand, forecasts for El Nino conditions and a stressed U.S. consumer that is likely to be motivated to conserve as potential contributors to weak domestic demand.

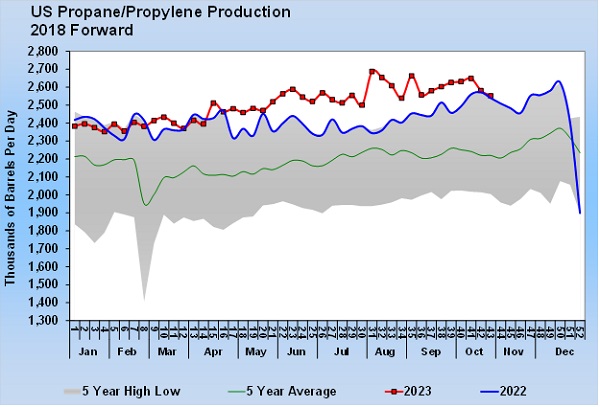

Meanwhile, U.S. propane production is near record highs.

So far this year, propane production has averaged 95,000 bpd more than last year. Around the end of July, new fractionation capacity was brought online with output reaching a record 2.687 million bpd. Whether we look at that number or the average production for this year of 2.504 million bpd, propane supply easily outstrips potential domestic demand for this winter.

At this point in our analysis, we are willing to use the five-year average winter demand of 1.452 million bpd rather than last year’s 1.382 million bpd, even though we have a bias that last year may turn out to be a more accurate reflection of this year’s demand. On the other hand, using this year’s average production is likely not to be reflective of what production will be through the winter. We believe production will average somewhere closer to 2.6 million bpd this winter. In addition to domestic production, the U.S. is likely to average about 160,000 bpd in propane imports for a total supply of 2.76 million bpd.

Using 2.76 million bpd for propane supply and 1.452 million bpd for domestic propane demand, propane exports must exceed an average of 1.308 million bpd to cause a draw on inventories. So far this year, propane exports have averaged 1.586 million bpd, up 265,000 bpd more than last year. Many analysts are expecting this export number to continue to rise because of new demand, especially from China. China has built a lot of new propane dehydrogenation (PDH) plants that will convert propane into propylene. There is also the fact that OPEC+ has cut its crude production to support crude’s price. That impacts natural gas liquids (NGL) output from those producers, putting more demand on U.S. propane supply. Since September, U.S. propane exports have averaged 1.740 million bpd. Let’s assume that is closer to the export demand that will be seen for the remainder of this winter.

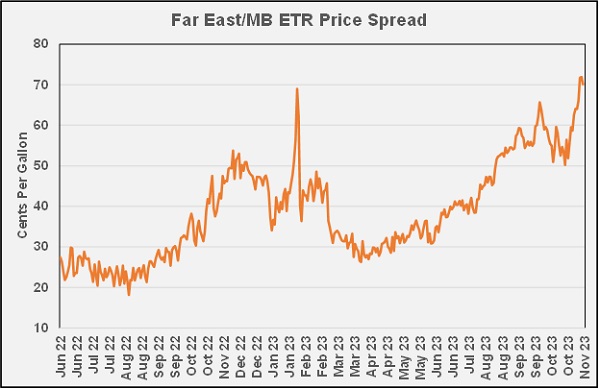

Chart 3 shows the price spread between Mont Belvieu propane and Far East propane. The economies are there to entice exports. All that’s needed is demand.

There are some questions about the export demand, though. Just because China has a lot of new PDH capacity doesn’t necessarily mean it is going to use it. Whether it gets used or not will depend on the health of the global economy, which is in question. Just last week, data showed China’s manufacturing activity slipped into contraction. There may not be demand for the propylene that would be used in plastics manufacturing, which would mean PDH utilization might run well below capacity.

If we use 2.76 million bpd for U.S. propane supply, 1.452 for domestic demand this winter and 1.740 for propane exports, the average draw on propane inventory would be 432,000 bpd. With about 150 days left in the winter period, that would draw inventory 64.8 million barrels over the winter and leave them at 36.399 million barrels. There is the ultra-bullish case for propane prices for the winter of 2023-24.

If propane inventory draws get anywhere near a track that would leave them at 36.399 million barrels at the end of winter, propane would easily rise in value to its normal 50 percent of WTI, if not higher. That track would require inventory draws averaging 3 million barrels per week.

This track would require propane production to remain below the peak it recently reached. It would require domestic demand to be at the five-year average for this winter. It is currently at last year’s below-average level. It would also require propane exports to keep the very strong pace they have had over the past couple of months. That will be impacted by how economic conditions unfold over the winter period.

The good news for propane buyers is that they don’t have to know right now if all of those things will come together. Nobody can know it for sure. Right now, we just need to be aware of the possibility, even if on the remote side. Then we can monitor all the numbers used in this analysis and see if they are coming to fruition. But mostly, we need to be on the lookout for 3-million-barrels-plus inventory draws. If we get those on a regular basis, more price protection for the second half of winter becomes viable. Until then, we trade the current high inventory position and make the other data points prove they can happen.

All charts courtesy of Cost Management Solutions.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.