Crude releases could make propane buyers complacent

April 17, 2023 By Mark Rachal

Cost Management Solutions’ Mark Rachal evaluates how releases from the U.S. Strategic Petroleum Reserve will impact prices.

Read More

Cost Management Solutions’ Mark Rachal evaluates how releases from the U.S. Strategic Petroleum Reserve will impact prices.

Read More

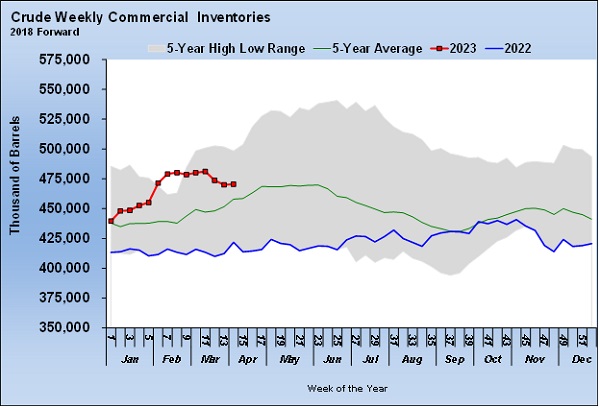

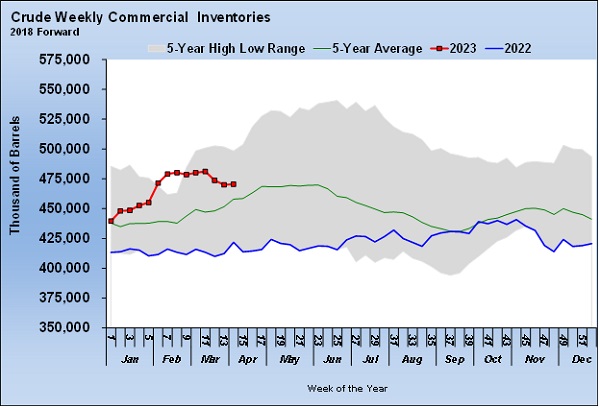

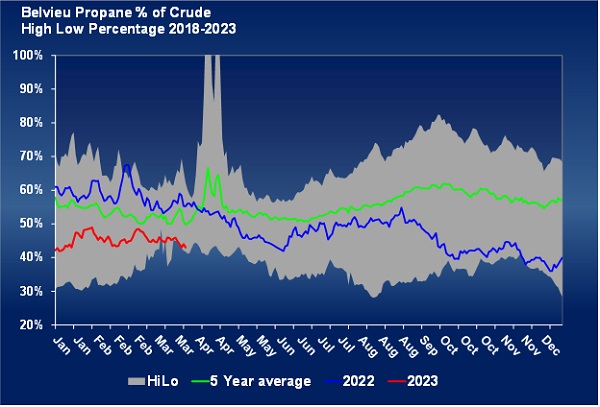

Because propane is a byproduct, its price is heavily influenced by what is going on with other commodities, namely crude and NGLs.

Read More

Cost Management Solutions saw prices move outside of the benchmarks for both crude and propane in the weeks after it shared its current short-term benchmarks with readers.

Read More

Propane fundamentals changed in 2020, causing the inventory overhang to be eliminated and pushing propane to the 50/50 marks.

Read More

Producers voluntarily shut production during April, and the associated natural gas liquids loss dramatically impacted propane fundamentals.

Read More

While Saudi Arabia has called an emergency meeting of OPEC+, there is little doubt that U.S. production growth is very likely to slow in the future.

Read More

The price of crude has rebounded a little since, but the potential for it to go lower is still present due to demand destruction from COVID-19 and producers not cooperating to limit production.

Read More

Any forecast on propane prices begins with trying to determine where crude will be priced.

Read More

At this time of year, we expect refinery throughput to be lower. However, inventory has continued to fall this winter at a sharp pace.

Read More

Major producers, including OPEC countries and Russia, agreed to extend the production quotas implemented in January through the end of 2018.

Read More