Destinations evolve due to values, infrastructure

August 5, 2019 By Mark Rachal

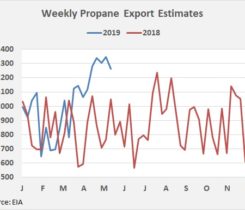

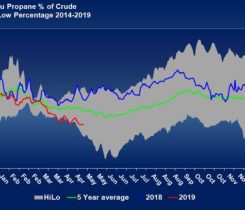

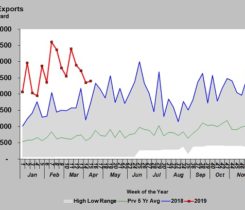

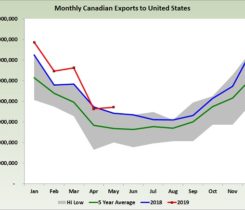

The focus of last week’s Trader’s Corner was Canadian propane inventory, which is setting five-year lows for this time of year. As we pointed out, a big reason is increased exports by Canadian producers.

Read More